Executive Summary

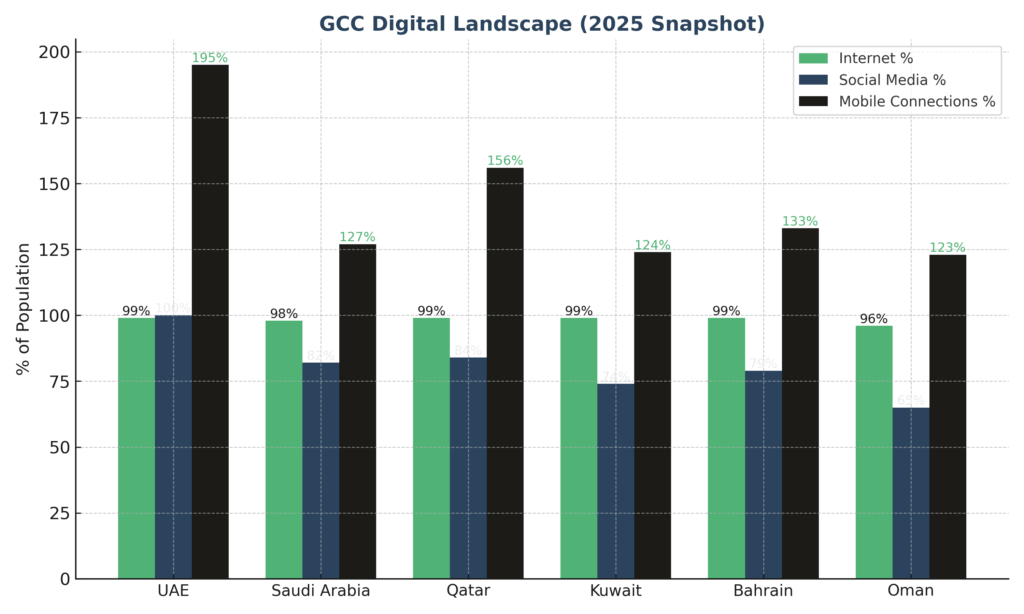

The Gulf region is one of the most digitally connected markets in the world. Across the GCC (UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman), brand reputation and consumer engagement increasingly play out in the digital space, on social media, forums, review sites, and through influencers.

Our research shows that in 2024–2025, leading brands in telecom, travel, FMCG, automotive, retail, and luxury are shaping conversations online. By analyzing digital mention volumes, sentiment indicators, and sectoral spikes, Sandstorm Digital highlights which brands dominate chatter, how consumer conversations are evolving, and what strategies will sustain brand advocacy.

Introduction

Brand mentions are no longer confined to press or traditional advertising. In the GCC’s hyper-connected societies , with mobile penetration >120% and social media usage often above 80% of the population, digital chatter is the single most important arena for brand visibility and reputation.

This white paper examines:

- Which brands dominate online conversations in key sectors

- What triggers spikes in mentions (campaigns, outages, events, seasonal cycles)

- How sentiment trends play out across different industries

- Strategic implications for marketers in the region

GCC Digital Landscape (2025 Snapshot)

Source: DataReportal 2025 Global Digital Overview

Implication: Digital campaigns in the GCC reach audiences with unparalleled scale and frequency. This saturation amplifies both positive and negative chatter, making brand mentions a volatile yet powerful metric.

Methodology

Our analysis integrates:

- YouGov BrandIndex (Buzz, Recommend, Consideration): proxy for digital WOM and positivity.

- Brand Finance Middle East 150 (2025): brand value momentum as a measure of media gravity.

- Sectoral Sentiment Indices (e.g., KPMG GCC Banking 2024): real-time social sentiment as validation.

- Social Listening Platforms (Crowd Analyzer, Meltwater, Talkwalker): Arabic + English brand tokens to track spikes and online narratives.

Sectoral Findings: Online Brand Chatter

1. Telecom & Technology

- e& (UAE): World’s fastest-growing brand by value in 2025, at $15.3B, fueled by digital transformation campaigns【0search13†source】.

- stc (KSA): Among the region’s strongest brands; its Vision 2030 role ensures sustained digital chatter.

- du / Virgin Mobile: Rising mentions tied to competitive pricing and service campaigns.

Pattern: Online conversations spike around service innovation (AI, 5G, cloud) but also during network outages, showing both opportunity and risk.

2. Travel & Hospitality

- Emirates: Ranked #1 globally for Recommend (88.4%) in 2025, translating into vast positive digital WOM.

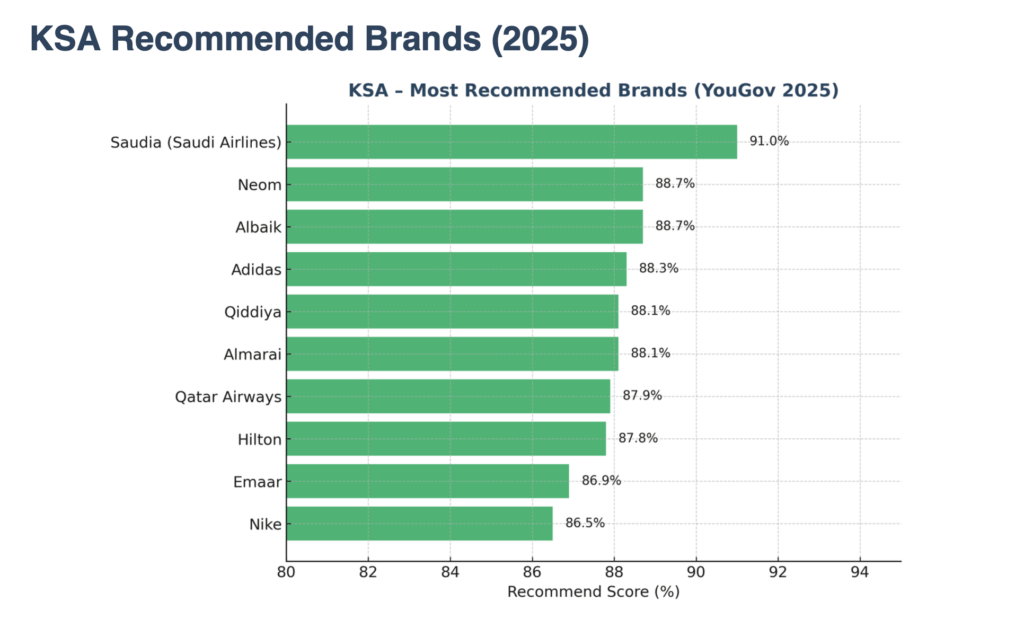

- Saudia: Top-recommended brand in Saudi Arabia (2025).

- Luxury hotels (Jumeirah, Four Seasons, Hilton): Drive chatter through guest experiences, influencer stays, and property openings.

Pattern: Premium storytelling and experiential content generate organic, positive mentions with global spillover.

3. Food & Beverage / CPG

- Pepsi, Coca-Cola, 7Up: Top beverage brands in UAE/KSA Consideration rankings (2024).

- Almarai: Consistently the leading food brand in GCC chatter.

- Agthia / NFPC: Mention spikes during Ramadan campaigns and health-focused launches.

Pattern: Seasonality (Ramadan, sports tournaments) reliably fuels digital conversation volume.

4. Automotive

- UAE market (2024): Vehicle sales up 19.1% YoY to ~330.5k units; Toyota #1, Nissan #2.

- Luxury brands (Mercedes, BMW, Ferrari, Lamborghini): Consistently feature in aspirational digital chatter.

- Dealership groups (Al-Futtaim, Abdul Latif Jameel, AAC, Al Tayer): Generate mentions around launches, test-drives, and influencer partnerships.

Pattern: Video content (POV test drives, reels, influencer reviews) dominates digital mentions.

5. Fashion, Retail & Luxury

- GCC personal luxury market (2024): Valued at $12.8B (+6% YoY); set to grow with 7–8 new luxury malls by 2027.

- Majid Al Futtaim (MAF): Reported AED 33.9B revenue in 2024, sustaining high retail/event mentions.

- Alshaya: Expanded Aura loyalty with Mastercard, boosting digital engagement.

Pattern: Online chatter spikes during store openings, luxury collaborations, and loyalty rollouts.

Key Cross-Industry Insights

- Innovation and Crises are Mention Triggers

Telecom and banking sectors show how product launches and outages equally dominate online chatter. - Experience Drives Positive WOM

Airlines and hotels with strong experiential narratives (Emirates, Jumeirah) earn global positive mentions. - Seasonality is Predictable Fuel

FMCG and beverage brands can plan always-on digital activations around Ramadan, Eid, and football. - Visual Culture is Critical

GCC digital audiences respond strongly to visual storytelling rooted in local culture, making imagery as important as text. - Retail Events as Buzz Engines

Malls and loyalty programs consistently trigger spikes in UGC, influencer chatter, and earned media.

Strategic Implications for Brands

- Social Listening at Scale: Track Arabic/English mentions and respond in real time.

- Influencer Seeding: Engage micro-influencers to pre-seed chatter ahead of campaigns/events.

- Sentiment Filtering: Pair mention spikes with sentiment analysis to distinguish positive virality from crises.

- Content Strategy: Prioritize culturally resonant visuals and short-form video (Reels, TikTok).

- Proactive Thought Leadership: Brands should position themselves as industry voices (e.g., e& publishing AI POVs).

Conclusion

Digital brand chatter is now the leading indicator of brand health in the GCC. National champions (e&, stc, Emirates, Saudia) and global FMCG leaders (Pepsi, Nestlé, Coca-Cola) consistently dominate mentions, but local players (Agthia, NFPC, MAF, Chalhoub) are equally adept at generating spikes during seasonal and retail events.

For marketers, the opportunity is clear: leverage listening, influencer ecosystems, and cultural storytelling to capture share of digital voice (SOVd).